How Much of Monthly Income Should Go to Housing

Alex has served in the financial industry for over 20 years, assisting with client portfolios in addition to his personal investments.

Why Sell Puts and Covered Calls For Income?

A 1999 study by the Chicago Mercantile Exchange, "CME Exercised/Expired Recap for Expired Contract Report", determined that approximately 76.5% of all put options expire worthless.

When we purchase an option, we can only realize a profit when our market direction bias is correctly aligned with the direction at which the market is moving. Furthermore, not only does the direction of the market need to be correct, our prediction of the direction has to be accurate within a predetermined time frame, or it will similarly result in an overall loss, due to the expiry of the purchased option before any profit could be realized.

As a result of the above, you can see the argument for shifting one's mentality to that of a seller's position, in the expectation that the majority of all options written would expire out-of-the-money. This is why the process of selling puts, followed by call options, remains as a consistent option strategy in providing monthly cash flow.

The Strategy of Selling Put and Call Options

Through recent developments in technology allowing for the entry of retail traders, we have started to grasp the power and consistency of selling options, and their position in a retail trader's investment portfolio.

The strategy detailed below shows how, under current conditions, one can generate monthly income from selling options, and consistently make returns exceeding 1% per month. This equates to over 12% a year with minimal volatility and portfolio drawdown.

The Strategy

The strategy revolves around selling monthly put options on shares of companies with good fundamentals which we would look to own. These put options consistently provide a cash return immediately into our account each time the options expire out-of-the-money, which essentially creates a stream of income without having ownership of these stocks.

Times of high volatility in the markets would be looked favorably as it often signals a correction in the price of the general markets. This provides for an increase in the option premium income, together with good purchasing opportunities.

These opportunities can be realized when the initial put option finally is exercised at the predetermined strike price at which we would be comfortable with purchasing the underlying stock. Furthermore, the premiums generated from the initial option selling further decreases the cost basis of each unit of stock that would ultimately be purchased.

Following the acquisition of the stocks at discounted prices, the strategy is then followed by the selling of out-of-the-money call options. In the worst-case scenario, should these call options remain out-of-the-money and expire worthless, the seller would be entitled to keep the full premium generated and then proceed to write a further call option. In the best-case scenario, the price of the underlying share may begin to rally past the strike price. In this scenario, the shares would be called away at a profit while similarly pocketing the premiums generated from the original writing of the call option itself.

Case Study: Nike, Inc.

As discussed in the strategy section, companies with good fundamentals would first need to be identified. This is then followed by identifying a suitable purchase price through the selection of the option's strike prices.

Step 1: Selling cash-secured naked puts

This first step allows the purchase of shares in companies with strong fundamentals at discounted prices compared to the current trading price. Simultaneously, the premium income generated aids in lowering the cost basis of each share. We will use some historical numbers to look into this.

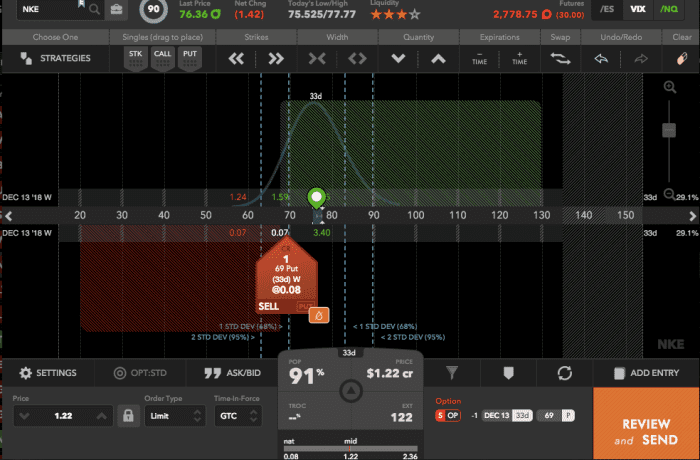

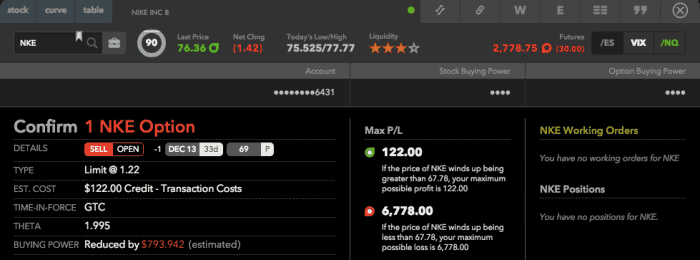

For example, as of 11 November 2018, Nike shares ("NKE") are currently trading at $76.36 on the NYSE. I identified that $69 was a suitable price to purchase NKE shares (approximately a 10% discount to the current $76.36 market price) over the next 33 days. For this contract, $122 in premium income would be generated for each put contract sold. As shown in the screenshot below, a margin maintenance of $793 is required until this cash secured put option expires.

For 33 days, the $793 maintenance requirement is able to return $122 in premium income, representing a 15% return; while we wait to purchase NKE shares at a 10% discount. In order to decrease risk, selling an even further out-of-the-money option to generate 1% return a month would be more conservative, as opposed to the 15% return example above. This thereby increases the margin of safety and possibility of purchasing NKE shares at an even larger discount compared to the current price.

After 33 days, in the worst-case scenario, NKE remains above the $69 strike price therefore expires out-of-the-money. This allows the option seller to retain the full $122 premium as income, and look to repeat the process by selling another contract.

In the best-case scenario, the share price of NKE falls below the $69 strike price resulting in the put option being exercised. This contracts the seller to purchase NKE shares at $69. However, this would be considered discounted to the original $76.63 trading price. Further, the $122 premium (or $1.22 per share) allows for a decrease in the cost price per share to $67.78 ($69 less $1.22).

As demonstrated, selling cash secured put options can be a strategy that allows for the opportunity to purchase stock at discounted entry prices, while being able to generate high monthly income comparable to other riskier high-interest investment methods.

Read More From Toughnickel

Live trade on Nike shares - Cash secured put option selling.

Copyright Dr Poeta Diablo

Step 2: Selling covered CALLS

The next step focuses on selling call options to generate income, in addition to the gains derived from the appreciation of the stocks itself.

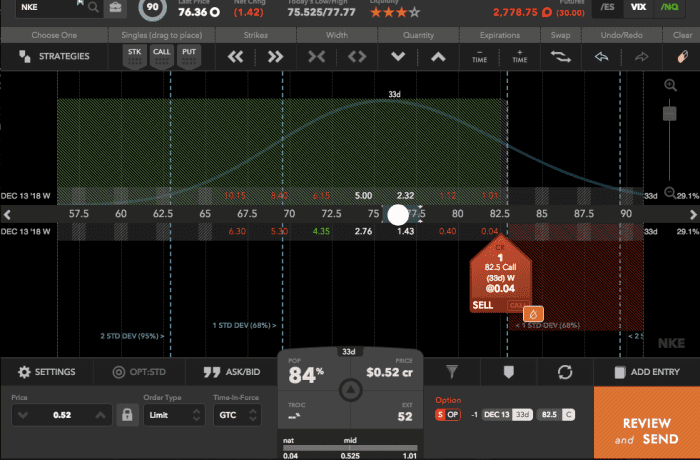

Following the acquisition of the NKE shares at the price of $67.68 (calculated above), the option seller can now look to sell covered call options on these shares. It is called a covered call as the seller retains the underlying shares which may be be called away, and therefore the seller's exposure is considered "covered".

Consistent with the original $67.68 cost basis of each NKE share, an exit price can also be predetermined. Based on the live charts below, a call option with 33 days to expiry can be sold at a strike price of $82.50. Should this call option be exercised in the next 33 days, it would represent a 21% gain on sale ($82.50 / $67.68). In addition, a further $52 in option premium would be brought in as income further decreasing the cost basis of the shares.

Looking at the possible scenarios that may follow, the worst-case scenario would see the call option expires worthless and out-of-the-money. This would be followed by a subsequent write order to sell another covered call option, while retaining the full premium from the first sale.

In the best case scenario, the share price of NKE breaches the $82.50 strike price, resulting in contracting the shares to be called away. This is the best-case scenario as the seller would be able to profit from this trade twice through the crystallisation of the capital appreciation in the share price, in addition to retaining the full premium income.

Once these shares are called away, the option seller can then look to return back to Step 1 and repeat the process by selling out-of-the-money put options on strong companies at discounted strike prices.

Copyright Dr. Poeta Diablo - Live trade of a covered call option sale.

Why Selling Options is Superior to Buy and Hold

A consistent 1% per month, or 12% per annum return:

There is no requirement to execute an options trade close-to-the-money that entails a high risk in order to achieve high yielding profits. This strategy looks to generate 1% a month on the overall trading portfolio consistently. Prior to considerations of the compounding effect from a monthly return, an option seller should be able to achieve an annual return of at least 12% per year with minimal volatility and draw down on their portfolio.

The wide margin of safety is available for inherent errors:

As an option seller, option premium is received every time. This premium is received via a cash transaction into the seller's account the moment the option was sold. The cash collected is able to provide for a margin of safety by lowering the cost price of the underlying share purchase once exercised.

The option seller is also in a position to predetermine the strike price of the options prior to the sale. Through this, we are able to effectively create an opportunity to purchase quality companies at discounted prices. Along the same lines, the seller of a call option can similarly predetermine the strike price of the call options allowing for the opportunity to sell the shares at a price above the original purchase price.

A high probability of profit:

The strike price of the put and call options sold would be considered deep out-of-the-money and therefore carry a high probability of profit. In the NKE trade example, NKE would be required to fall by at least 10% within a 33 day period before the strike price is breached.

Less time commitment required to monitor portfolio positions:

The example above revolved around a 33 days-to-expiry time frame. This suggests that there would not be an active requirement to monitor this trade for the following 33 days until it nears expiry. This is fully attributable to the fact that the predetermined strike prices allow the option seller to preempt the purchase price (put options) and sale price (call options) ahead of time.

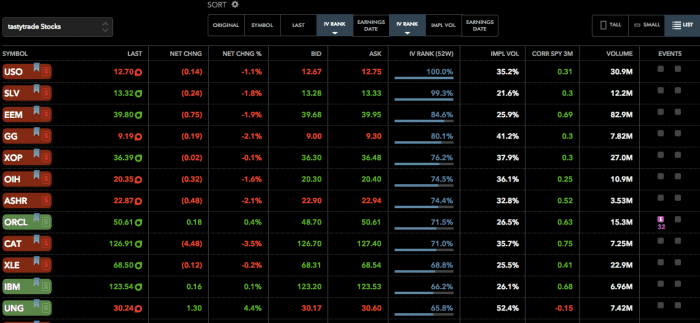

Example list filtered by high IV rank based on implied volatility

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2018 Alex Hills

How Much of Monthly Income Should Go to Housing

Source: https://toughnickel.com/personal-finance/how-to-generate-monthly-income-from-options-selling

0 Response to "How Much of Monthly Income Should Go to Housing"

Post a Comment